AFGHANISTAN- A FRENEMY & A GRAVEYARD FOR THE EMPIRES

History is great teacher, if one

takes cues from it and move on keeping the events in view.

The image above is seen worldwide

is much more than a few Taliban occupying the table in the Presidential Palace

of Afghanistan, but is for the framed painting put up on the wall that everyone

seems to miss.

The painting is of one Seer in

white, Darbesh Shah, blessing a person bowed in his front with a bunch of

ripened wheat grass, a symbol of prosperity.

The person getting blessed is

Ahmed Shah Abdali, the most respected Afghan ruler in history. We would soon

discover more about him in a gist.

Afghan history is sharpened with events

that are resplendent with treachery and deceit. So, I am befuddled, as to why,

the world is feigning ignorance. History strikes hardest to the society that

feigns ignorance.

The modern day Afghanistan is

largely credited to Ahmed Shah Abdali, who later assumed the name as Ahmed Shah

Durrani.

Around 1738, at an age of

sixteen, he was taken in by Nader Shah Afshar, the ruler of Persia, as Garrison

Commander of Afghans.

The modern day Afghanistan is

carved out of such empires by Ahmed Shah Abdali, who travelled as Afghan

Garrison Commander with Nadir Shah to loot and plunder India many times. Nader

was assassinated in 1747 by his own confidants.

Abdali, a confidant of Nader

Shah, also betrayed Nader Shah after his death in 1747 and took the Kohinoor

ring, which Shah had looted from the India. Abdali took that Kohinoor ring from

the dead body of Nader Shah’s finger and wore it and declared himself as ruler.

It was Nader Shah who gave Ahmed

Shah Abdali the name of Durre Durrani- The pearl of the era.

Ahmed Shah took the name of Ahmed Shah Durrani then on.

The Afghans chose Durrani as

their head of state Durrani and his Afghan army conquered most of

present-day Afghanistan, Pakistan, and part of Iran. He even defeated the

Indian Maratha Empire, and one of his biggest victories was the 1761

Battle of Panipat, a battleground where history of India has a long trail.

So, the medieval history, rolling into

twenty first Century, of Central Asia & Persian Gulf Region is a history of

power, greed, betrayal and blood on hand and boundaries getting defined with

every victory and defeat.

So, I do not see why the world is

blaming Taliban for Afghanistan mess. Tribal wars & holy wars are part of

their legacies and the country & the region is at constant wars amongst

warlords for riches and outreach.

I prefer to call Afghanistan a FRENEMY-

a country that pretends to be friend but in fact is

not so in reality for the precise historical reasons above. Afghan army even

attacked India in Kashmir & occupied on behalf of Pakistan an area that we

know today as POK or Pakistan Occupied Kashmir.

This must be the Afghan lesson

that USA learnt after being bitten twice & shied several times in

Afghanistan.

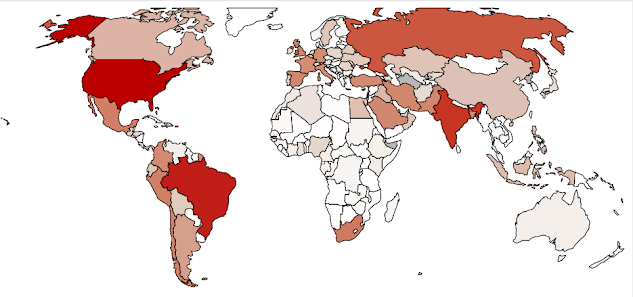

History has witnessed Afghanistan as a

proven “graveyard of empires”, from 19th-century British Empire to the

20th-century Soviet empire & now America.

It seems that in past two decadal

years & more, every step that USA took was a misstep. Thus the turn of

events in Afghanistan has been alarming but not surprising.

The Taliban’s rapid takeover

of the country culminating in their march to the capital was almost unopposed

as President Ashraf Ghani fled the country- allegedly with 150 million US

Dollars in Cash.

This is a clear pointer that democracy

cannot be forced through the gullet to a society that has never believed in the

power of democracy and has proceeded the way it has in its own way- the

tribalistic ruthlessness for ethnic cleansing and holy wars.

USA’s idea of democracy fell flat on its

face in Afghanistan where religious hardliners rules above all and any voice

against it is silenced by a bullet.

The recent Trump administration’s

decision to engage the Taliban diplomatically was the beginning of the US

surrendering to the hardliner groups. Biden administration just hastened that

process by complete withdrawal.

But was it really inevitable and

a fait-accompli?

As I see it- US always controlled

the timings of its troop deployments, but the Taliban had the time at hand.

More importantly- Taliban had the will.

As a matter of fact, since World

War II, the US has failed to decisively win any major war, whether in Korea,

Vietnam, Iraq or Afghanistan.

The humiliation may be the one silver

lining after the two decades of tragedy & horrific wars in the greater

Middle East as Oil is no more the liquid gold and USA need to stop the plunder

and pounding for the pot of gold at the end of the rainbow.

From mid twentieth Century

onwards, the raiders & the raided have switched positions and reverse

plundering started of Middle East & Central Asia, thanks to its rich oil

& gas finds and critical minerals needed for twenty first century.

Now the emerging Superpowers,

like China, Russia have recognised the Taliban for Government formation for the

simple reason of raiding and usurping its mineral wealth and to capitalise on

its strategic location in scheme of the thing like BRI / OBOR initiative of

China.

In due course of time, USA would also

recognise Taliban Government for its long term strategic interests- it cannot

afford to lose its foothold in the region. It can ill afford to give the

deckhand now to China & Russia.

In larger scheme of the things,

India does not stand anywhere despite its claims of investments of three

billion US Dollar, a paltry sum by global standards and the countries that it

poses to stand with, in that country.

It was clear when Trump

administration struck a deal with Taliban in Doha in February 2020 for peaceful

US troop withdrawals. India was not even invited initially to the table as a

stakeholder & desperately sought backchannel diplomatic route to have a

seat, but no say.

The new state players, like

China, are just looking at the prospect of Afghanistan from materialistic point

of view and are emboldened by their Pakistan support (what a fallacy China is

living with them).

Afghanistan is rich in resources like copper, gold,

oil, natural gas, uranium, bauxite, coal, rare earths, lithium and many other

mineral deposits. It was estimated to be worth more than three trillion US

Dollars during the last commodity super cycle. China is precisely looking at

prospecting those mining deposits.

But taming Afghanistan would be

much harder than the Central Asian grassland countries under erstwhile USSR.

Taliban can give China a taste of their

own noodles and can easily renegade from all commitments. Indeed, it would the

matching of the minds that we must observe very closely as it unfolds.

In the words of the ancient Greek

emperor, Alexander, wars are easy to march into but hard to

march out of.

China could be the next empire that just

may find it facing the syndrome of Afghanistan blight- A Graveyard for Empires.